Financial highlights

In financial terms, Pearson's goal is to achieve sustainable growth on three key financial goals - earnings, cash and return on invested capital, and reliable cash returns to our investors through healthy and growing dividends. Over the past five years we have produced, on average, 15% growth in earnings and 11% in cash flow. And we have sustained our growth even in the face of very tough economic and market conditions in recent years.

| 2011 £m | 2010 £m | Headline growth | CER growth | Underlying growth | |

|---|---|---|---|---|---|

| Business performance | |||||

| Sales | 5,862 | 5,663 | 4% | 6% | 1% |

| Adjusted operating profit | 942 | 857 | 10% | 12% | 7% |

| Adjusted profit before tax | 890 | 853 | 4% | ||

| Adjusted earnings per share | 86.5p | 77.5p | 12% | ||

| Operating cash flow | 983 | 1,057 | (7)% | ||

| Total free cash flow | 772 | 904 | (15)% | ||

| Total free cash flow per share | 96.5p | 112.8p | (14)% | ||

| Return on invested capital | 9.1% | 10.3% | (1.2)% pts | ||

| Net debt | (499) | (430) | (16)% | ||

| Statutory results | |||||

| Operating profit | 1,226 | 743 | 65% | ||

| Profit before tax | 1,155 | 670 | 72% | ||

| Basic earnings per share | 119.6p | 161.9p | (26)% | ||

| Cash generated from operations | 1,093 | 1,169 | (7)% | ||

| Dividend per share | 42.0p | 38.7p | 9% |

Notes Throughout this document:

a) Growth rates are stated on a constant

exchange rate (CER) basis unless otherwise stated. Where quoted,

underlying growth rates exclude both currency movements and

portfolio changes.

b) Interactive Data was treated as a discontinued business in 2010

and sales and operating profit are stated on a continuing business

basis, excluding Interactive Data from 2010. Until its sale on 29

July 2010, Interactive Data contributed 2010 revenues of £296m and

2010 adjusted operating profit of £81m.

c) The 'business performance' measures are non‑GAAP measures and

reconciliations to the equivalent statutory heading under IFRS are

included in notes

2, 8 and 33 to the annual report.

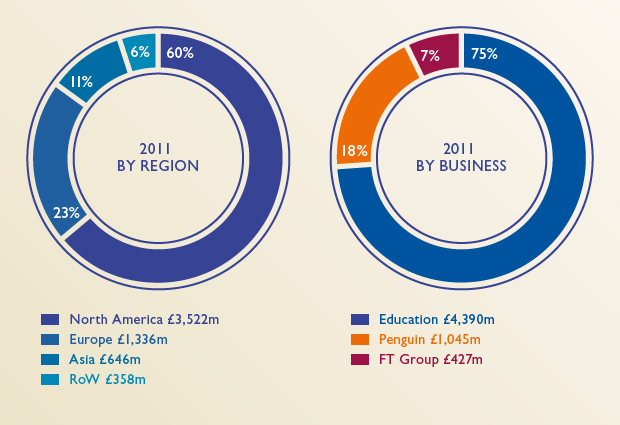

2011 Sales £5.9bn +6%

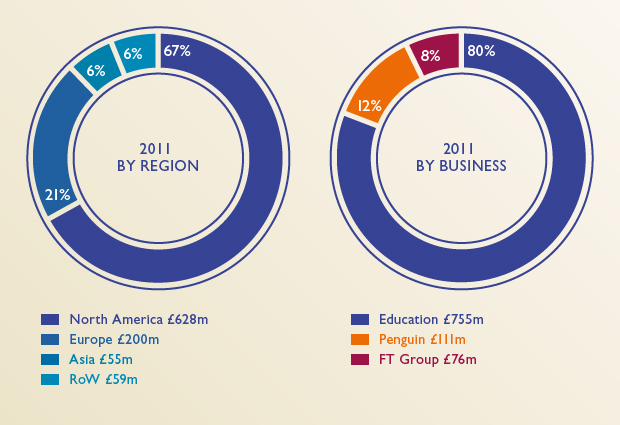

2011 Adjusted operating profit £942m +12%

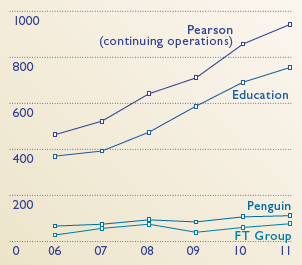

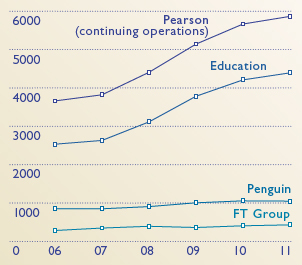

Our five-year record

Average annual growth in headline terms, 2006-2011

Adjusted earnings per share +15%

Sales £m

Operating cash flow +11%

Adjusted operating profit £m