Chairman's introduction

Dear shareholders,

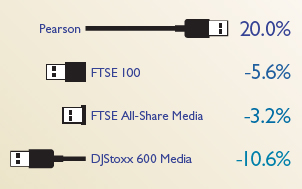

Over the course of 2011, the value of our shares increased by 20%. They ended the year at a little over £12, their highest level for a decade. That growth was ahead of both the overall market (the FTSE100 was down 5.6%) and our sector (the DJ Stoxx 600 Media index was down 10.6%).

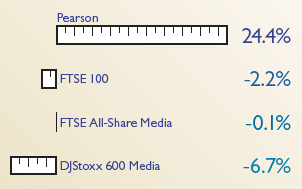

Add in the dividend and Pearson’s total return to shareholders was 24.4% in 2011. This was ahead of the FTSE 100 (down 2.2%) and the DJ Stoxx 600 Media index (down 6.7%).

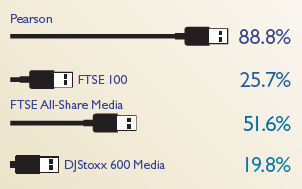

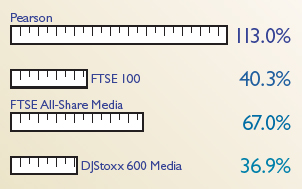

On a longer term view, our shares are up by almost 90% over the three years to the end of 2011 and by more than 50% over five years. Our total shareholder return is 113% over three years and 93% over five years.

This is a record we take some pride in. The board concentrates its time and energy on doing all we can to sustain it, even in the challenging economic conditions that face us. We do that by focusing on the following inter‑related themes that we examine in more detail through this report.

Share price performance

One year % change

(01.01.11 - 31.12.11)

Three year % change

(01.01.09 - 31.12.11)

One year %

(01.01.11 - 31.12.11)

Three year %

(01.01.09 - 31.12.11)

Strategy

For more than a decade now, Pearson’s strategy has revolved around our commitment to become the leading global learning company. The company saw tremendous social and economic need for education and skills, giving rise to significant business opportunities. We have therefore initiated – and continue to pursue – a radical shift in our business portfolio towards education.

That focus on lifelong learning has been accompanied by three related and ongoing changes in:

That focus on lifelong learning has been accompanied by three related and ongoing changes in:

- what we deliver (from products to services);

- how we deliver it (from print to digital); and

- where we operate (from developed world to faster‑growing developing economies).

As always, Marjorie provides a vivid description of how we are applying our strategy, and adapting to accelerating structural change in our industries, in her review.

Performance

The board and management closely monitor the performance of Pearson’s businesses against strategic and operating plans.

As our strategy unfolds, we are seeing some fundamental changes in the dynamics of our business. We are therefore developing additional measures of business and financial performance more appropriate to our changing business models.

We discuss these changes in detail within our performance section.

Governance

The board believes that good governance is closely linked to effective long‑term strategy and value creation. The board agenda reflects our key priorities: Governance, Strategy, Business Performance and People.

We focus on board composition, board effectiveness, succession planning and engagement with shareholders.

We set our framework and policies in the Governance section.

Risk

The board, the audit committee and management devote a good deal of time to evaluating, monitoring and mitigating traditional business risks from the impact of economic recession to business continuity to the loss of key assets or people.

We also focus on newer risks that arise both from our evolving strategy and the changing economic, political and competitive environment. These newer risks include the emergence of disruptive technologies and technology‑based competitors; operational and management challenges related to doing business in emerging markets; managing change in our traditional print‑based publishing businesses; and protecting the reputation of Pearson and our world‑famous brands.

We discuss these changes in detail within our strategy and performance sections.

Change at Pearson

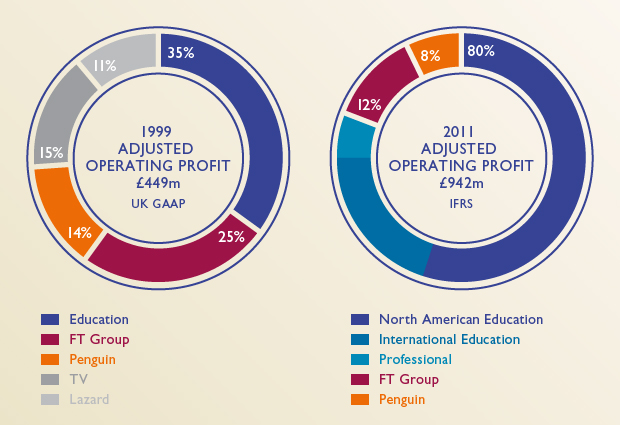

Operating profit

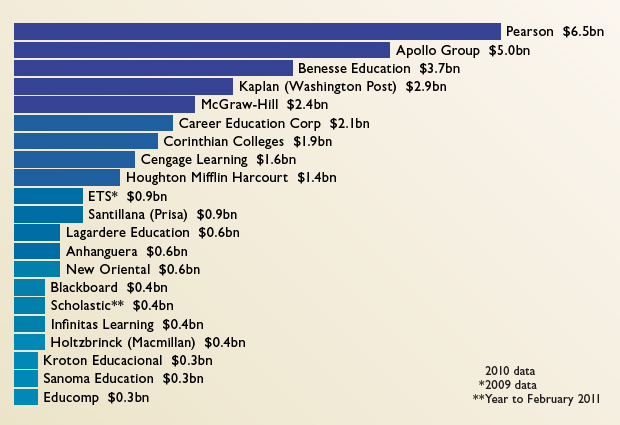

The world's leading education companies

Education revenues $bn

Remuneration

The board’s commitment to long‑term value creation through a clearly‑defined strategy sets the agenda for our approach to remuneration. We set high performance hurdles for Pearson’s senior managers. Where they have done well, our shareholders have done well too.

Even so, the board is deeply aware of the public debate and mood over executive compensation. This has influenced our remuneration plans for 2012.

We set out our policies and plans in full in our Remuneration report.

Responsibility

The board is keenly aware that Pearson’s long‑term value and franchise rests on fulfilling a social purpose. We exist to help improve people’s lives through learning. Our value is a by‑product of helping teachers teach and students learn; of helping business people understand the world and make good decisions; of informing and entertaining readers through one of life’s greatest pleasures – a good book.

This is our core purpose and business, and we discuss it in detail both in Marjorie’s Strategy review and in our Impact on society report.

We hope that shareholders find that this report adds both to their understanding of the company and to the way we approach our opportunities and responsibilities. We welcome your feedback on its content, and as always we very much hope to see you in person at our annual shareholders meeting at the end of April.

Glen Moreno, Chairman