Financial Times Group

Key performance indicators

| £ millions | 2011 | 2010 | Headline growth | CER growth | Underlying growth |

|---|---|---|---|---|---|

| Sales | 427 | 403 | 6% | 8% | 7% |

| Adjusted operating profit | 76 | 60 | 27% | 22% | 17% |

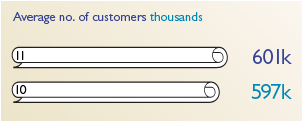

FT.COM registered

users

Total paid content

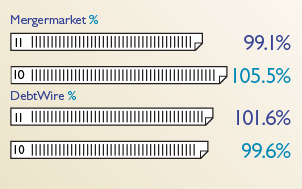

Mergermarket renewal rates

The FT Group is a leading provider of essential information in attractive niches of the global business information market. These include insight, news and analysis offered through a growing number of print, digital and mobile channels. In recent years, the FT Group has significantly shifted its business towards digital, subscription and content revenues, divested its data businesses and has continued to invest in talent and in services in faster‑growing emerging markets. In 2011, FT Group produced strong revenue and profit growth with digital and services now accounting for 47% of FT Group revenues, up from 25% in 2007. Content revenues comprised 58% of total revenues, up from 41% in 2007, while advertising accounted for 42% of FT Group revenues, down from 59% in 2007.

Financial Times highlights in 2011 include:

- The FT produced strong and accelerating growth in its digital readership with online subscriptions up 29% to 267,000, 2,000 direct corporate licences and FT.com registered users up 33% to more than four million. Combined paid print and digital circulation reached 600,000 in 2011, the highest circulation in the history of the FT. At the end of 2011, digital subscribers exceeded print circulation in the US for the first time. The Average Daily Global Audience across print and online grew 3% to 2.2 million people worldwide, our largest audience ever.

- Readership continues to migrate online and to mobile, which now generates 19% of traffic to FT.com. We launched FT web apps optimised for iPad and Android devices including a custom app for India. The web apps provide FT subscribers access to our content online and through mobile devices with a single subscription and data analytics allow us to better serve our customers. We also acquired Assanka, the FT’s web app development partner, which we expect to yield benefits in FT Group and across Pearson.

- Advertising was generally weak and volatile with poor visibility. Growth in online advertising and the luxury category was offset by weakness in corporate advertising.

- FT Conferences had a very strong year, operating 75 events in 37 cities worldwide. Almost 9,000 senior executives from around the world attended these events.

- We launched the FT Non‑Executive Certificate (in partnership with Pearson LearningStudio and Edexcel) in April 2011, enrolling more than 100 students. The certificate is designed to aid the professionalisation of the sector and increase diversity on UK boards. It is the first fully accredited formal education product for non‑executive directors.

- We extended the breadth and depth of the FT's premium subscription services through the launch of Brazil Confidential, extending our successful China Confidential franchise into another growth market; Medley Global Advisors (MGA) grew modestly despite challenging conditions for its customers due to new contract wins; Money‑Media grew strongly fuelled by an increase in subscriptions and advertising.

Mergermarket highlights in 2011 include:

- Mergermarket's strong editorial analysis continued to benefit from its global presence and product breadth. Usage increased, new sales grew and renewal rates were strong. Continued volatility in debt markets helped sustain the strong performance of Debtwire whilst volatile equity markets benefited dealReporter's event‑driven strategy. Mergermarket saw strong growth in Asia‑Pacific and the Americas while MergerID continued to benefit from a broadening network of users and strong growth in transaction matches.

- We launched a large number of new products, extending our reach into new geographies (US wealthmonitor, ABS Europe, dealReporter Middle East, dealReporter Russia Desk), new strategies (multi‑strategy products), new coverage areas (municipal bonds, dividend arbitrage) and new platforms (mergermarket iPad app).

Joint ventures and associates highlights in 2011 include:

-

The Economist, in which Pearson owns a 50% stake, increased global weekly circulation by 1% to 1.49 million (for the July - December 2011 ABC period) with an additional digital circulation in excess of 100,000; total annual online visits increased to 165 million, up 39% on 2010.

-

Business Day and Financial Mail (BDFM), our 50% owned joint-venture in South Africa with Avusa, improved profitability with revenue increasing by 10%. The business benefited from growth in advertising and circulation revenues.

- We sold our 50% stake in FTSE International to the London Stock Exchange for net proceeds of £428m in December 2011: it contributed £20m to Pearson's operating profit in 2011.