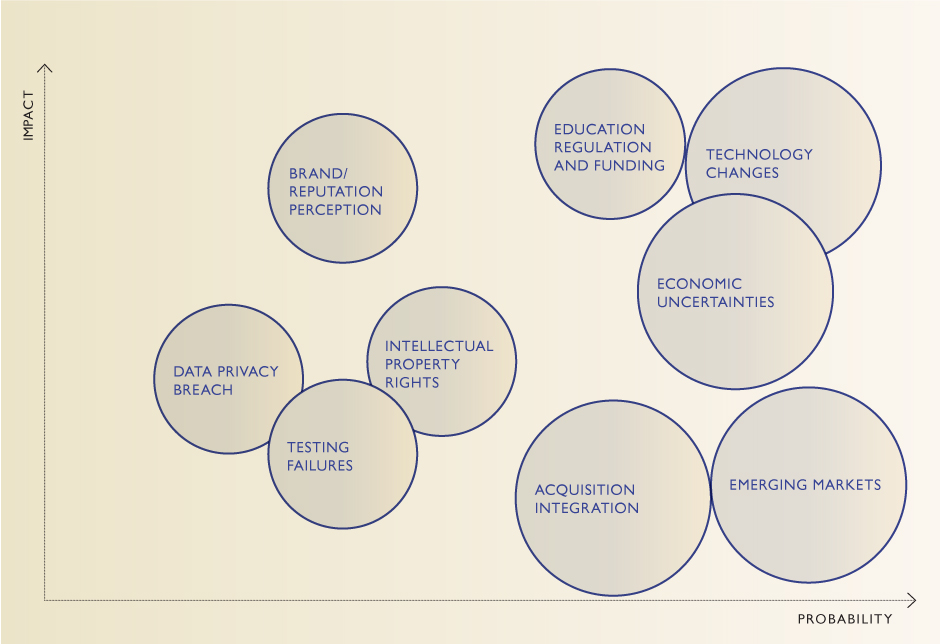

Principal risks and uncertainties

Our principal risks and uncertainties are outlined below. These are the most significant risks that may adversely affect our business strategy, financial position or future performance. The risk assessment process evaluates the probability of the risk materialising and the financial or strategic impact of the risk. Those risks which have a strong probability and significant impact on strategy, reputation or operations or a financial impact greater than Åí40 million are identified as principal risks. The risk assessment and reporting criteria are designed to provide the board with a consistent, Group‑wide perspective of the key risks. The reports to the board, which are submitted every six months, include an assessment of the probability and impact of risks materialising, as well as risk mitigation initiatives and their effectiveness.

We conduct regular risk reviews to identify risk factors which may affect our business and financial performance and to assist management in prioritising their response to those risks. Our Group internal audit and risk assurance function facilitates risk reviews with each business, shared service operations and corporate functions, identifying measures and controls to mitigate these risks. These reviews are designed so that the different businesses are able to tailor and adapt their risk management processes to suit their specific circumstances. Management is responsible for considering and executing the appropriate action to mitigate these risks whenever possible. It is not possible to identify every risk that could affect our businesses, and the actions taken to mitigate the risks described below cannot provide absolute assurance that a risk will not materialise and/or adversely affect our business or financial performance.

Principal risks - Impact and probability

| Principal risks | Mitigating factors |

|---|---|

Technology changesOur education, business information and book publishing businesses will be impacted by the rate of and state of technological change, including the digital evolution and other disruptive technologies.

|

We are transforming our products and

services for the digital environment along with managing our print

inventories. Our content is being adapted to new technologies

across our businesses and is priced to drive demand. We develop new

distribution channels by adapting our product offering and

investing in new formats. We continue to monitor contraction in the

consumer book market to minimise the downturn of bankruptcy. We mitigate these IT risks by establishing strong IT policies and operational controls, employing project management techniques to manage new software developments and/or systems implementations and have implemented an array of security measures to protect our IT assets from attacks or failures that could impact the confidentiality, availability or integrity of our systems. |

Education regulation and fundingOur US educational solutions and assessment businesses and our UK training businesses may be adversely affected by changes in government funding resulting from either general economic conditions, changes in government educational funding, programs, policy decisions, legislation and/or changes in the procurement processes. |

In the US we actively monitor changes

through participation in advisory boards and representation on

standard setting committees. Our customer relationship teams have

detailed knowledge of each state market. We are investing in new

and innovative ways to expand and combine our product and services

to provide a superior customer offering when compared to our

competitors, thereby reducing our reliance on any particular

funding stream in the US market. We work through our own government

relations team and our industry trade associations including the

Association of American Publishers. We are also monitoring

municipal funding and the impact on our education

receivables. In the Uk we maintain relationships with those government departments and agencies that are responsible for policy and funding. We work proactively with them to ensure our training and apprenticeship programmes meet existing and new government objectives at the right quality. |

Economic uncertaintiesGlobal economic conditions may adversely impact our financial performance.A significant deterioration in Group profitability and/or cash flow caused by prolonged economic instability could reduce our liquidity and/or impair our financial ratios, and trigger a need to raise additional funds from the capital markets and/or renegotiate our banking covenants. We generate a substantial proportion of our revenue in foreign currencies, particularly the US dollar, and foreign exchange rate fluctuation could adversely affect our earnings and the strength of our balance sheet. |

The Group's approach to funding is described in the Other financial information section and the Group's approach to the management of financial risks is set out in note 19 to the financial statements. |

Intellectual property rightsIf we do not adequately protect our intellectual property and proprietary rights our competitive position and results may be adversely affected and limit our ability to grow. |

We seek to mitigate this type of risk through general vigilance, co‑operation with other publishers and trade associations, advances in technology, as well as recourse to law as necessary. Data rights management standards and monitoring programs have been developed. We have established a piracy task force to identify weaknesses and remediate breaches. We monitor activities and regulations in each market for developments in copyright/intellectual property law and enforcement and take legal action where necessary. |

Emerging marketsOur investment into inherently riskier emerging markets is growing and the returns may be lower than anticipated. |

We draw on our experience of developing businesses outside our core markets and our existing international infrastructure to manage specific country risks. We have strengthened our financial control and managerial resources in these markets to manage expansion. The diversification of our international portfolio, and relative size of 'emerging markets' in relation to the Group, further minimises the effect any one territory could have on the overall Group results. |

Data privacy breachFailure to comply with data privacy regulations and standards or weakness in internet security result in a major data privacy breach causing reputational damage to our brands and financial loss. |

Through our global security we have established various data privacy and security programmes. We constantly test and re‑evaluate our data security procedures and controls across all our businesses with the aim of ensuring personal data is secured and we comply with relevant legislation and contractual requirements. We pursue appropriate privacy accreditations, e.g., TRUSTe Privacy and Safe Harbor Seal. We regularly monitor regulation changes to assess impact on existing processes and programmes. |

Testing failuresA control breakdown or service failure in our school assessment businesses could result in financial loss and reputational damage.Our professional services and school assessment businesses involve complex contractual relationships with both government agencies and commercial customers for the provision of various testing services. Our financial results, growth prospects and/or reputation may be adversely affected if these contracts and relationships are poorly managed. |

We seek to minimise the risk of a breakdown

in our student marking with the use of robust quality assurance

procedures and controls and oversight of contract performance,

combined with our investment in technology, project management and

skills development of our people. In addition to the internal business procedures and controls implemented to ensure we successfully deliver on our contractual commitments, we also seek to develop and maintain good relationships with our customers to minimise associated risks. We also look to diversity our portfolio to minimise reliance on any single contract. |

Acquisition integrationFailure to generate anticipated revenue growth, synergies and/or cost savings from acquisitions could lead to goodwill and intangible asset impairments. |

We perform pre‑acquisition due diligence and closely monitor the post‑integration performance to ensure we are meeting operational and financial targets. Any divergence from these plans will result in management action to improve performance and minimise the risk of any impairments. Executive management and the board receive regular reports on the status of acquisition performance. |

Brand/reputation perceptionOur business depends on a strong brand, and any failure to maintain, protect and enhance our brand would hurt our ability to retain or expand our business. |

We mitigate this risk through the development of comprehensive processes to enable our business units to effectively manage relationships with stakeholders, customers, communities and employees. We establish an ongoing process to understand and evaluate potential brand threats and monitor and evaluate information about our brand across media sources. |